The Crucial Role of Finance in Enterprise Navigation

Finance module of any enterprise serves as far more than a repository for transactions. It functions as the central nervous system that processes, interprets, and transmits vital information across the organization. The modern enterprise expects its finance system to provide real-time insights, drive strategic decision-making, and serve as a single source of truth for business performance.

Traditional accounting systems often fail to meet these expectations, creating disconnected silos of financial data that offer limited value for operational decisions. Today’s business leaders require finance tools that can navigate the enterprise through uncertainty, providing intelligent forecasting, risk assessment, and operational efficiency metrics that connect every facet of the business.

Generic Accounting Systems: The Limitations of Mere Bookkeeping

Conventional accounting software primarily focuses on basic bookkeeping functions—recording transactions, maintaining ledgers, and generating standardized financial statements. While these systems excel at organizing historical financial data, they typically operate in isolation from other business processes. This creates several significant limitations:

- Data Silos: Traditional systems rarely integrate with operational departments like sales, procurement, or production, forcing manual reconciliation and creating information gaps

- Reactive Rather Than Proactive: They provide backward-looking insights rather than predictive intelligence

- Limited Business Context: Financial data exists without the operational context needed to drive meaningful improvement

- Inflexible Reporting: Generic reporting tools fail to provide customized insights for specific business needs

- Manual Processes: Repetitive tasks consume valuable human resources that could be directed toward analysis and strategy

These shortcomings create a fundamental disconnect between financial reporting and business operations, leaving enterprises with a fractured view of their performance and limited ability to leverage financial data for strategic advantage.

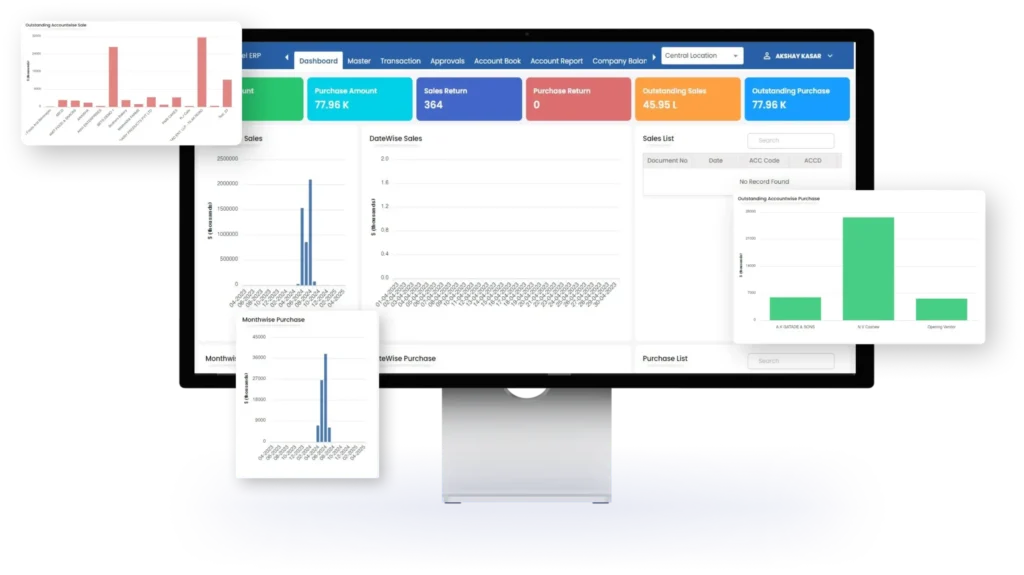

The BETs Finance Module: Reflecting Every Business Operation

The BETs Finance module represents a paradigm shift in financial management software by seamlessly integrating with every operational department. Unlike traditional systems, BETs Finance module serves as a mirror reflecting the financial implications of all business activities in real-time:

- Procurement Integration: Every purchase order automatically updated in finance module

- Production Connectivity: Manufacturing costs, wastage reports, and production efficiency metrics flow directly into financial analysis

- HR Integration: Payroll expenses, claims, productivity ratios, and human capital are automatically incorporated into financial reporting

- Sales Performance: Sales invoices, goods return, etc provide immediate financial context

- Expense Management: Automated tracking of all expenditures with departmental allocations and budget compliance monitoring

- Wastage Analytics: Financial impact of wastage across all departments with trend analysis and improvement tracking

This comprehensive integration eliminates data silos, providing a unified view of business performance that connects financial outcomes with operational activities. By creating this seamless flow of information, BETs Finance module transforms accounting from a record-keeping function into a strategic business intelligence tool.

BETs Finance Module: Comprehensive Capabilities

The BETs Finance module delivers enterprise-grade financial management through a comprehensive suite of integrated features:

Advanced Invoice Management

- Automated invoice generation based on sales orders, eliminating manual errors

- Manual invoice creation flexibility for special circumstances

- SS/Distributor-wise invoice management with consolidated PDF generation

- Digital invoice access through distributor operations login, reducing paper waste

Comprehensive Accounting Functions

- Sophisticated journal entries and general ledger management

- Complete voucher control for receipts, payments, and contra entries

- Inventory adjustments, credit/debit notes, cost center tracking

- Sub-contracting operations management within the accounting system

GST and Tax Compliance

- Auto-generation of GST-compatible invoices

- E-way bill and E-invoice integration

- Comprehensive tax reporting including TDS (26Q, 24Q, 27Q)

- e-TDS returns, Form 16 (Part A & B), Form 16A, and Traces integration

Financial Analysis and Reporting

- Full financial statement generation (Trial Balance, P&L, Balance Sheet)

- Group company consolidation and cash flow analysis

- Multi-currency support for global operations

- Automated bank reconciliation with smart matching algorithms

Operational Integration

- Transaction approval workflows with role-based permissions

- Payment reminder automation with escalation paths

- Integration for notifications and approvals

- Payment gateway and e-commerce platform connectivity

Audit and Compliance

- Complete audit trail tracking system

- Transaction verification workflows

- Comprehensive ledger confirmation system

- Role-based access controls for security and compliance

Business Intelligence

- Sales Channel-wise purchase trend analysis

- Item-wise and category-wise purchase analytics

- Customizable reporting periods (daily, weekly, monthly, quarterly, etc.)

- Integration with Tally or other systems if needed

This extensive feature of BETs Finance Module set creates a financial management ecosystem that extends far beyond traditional accounting, connecting financial data with every operational aspect of the business.

Conclusion: Finance as a Business Partner

The evolution from traditional accounting to BETs Finance module represents a fundamental shift in how businesses leverage financial information. Rather than functioning as a separate department focused on record-keeping and compliance, finance becomes an integrated business partner providing strategic insights across the organization.

BETs Finance module achieves this transformation by connecting every business operation—from procurement and production to sales and human resources—into a unified financial intelligence system. This integration eliminates information silos, reduces manual processes, and provides real-time visibility into the financial implications of all business activities.

For modern enterprises navigating complex markets and increasing competition, this integrated approach to financial management delivers significant competitive advantages. Decision-makers gain access to comprehensive financial context for operational decisions, enabling more accurate forecasting, better resource allocation, and strategic initiatives based on complete financial intelligence.

By implementing BETs Finance module, organizations transform their financial function from a necessary administrative department into a strategic asset that drives business performance and sustainable growth. In today’s data-driven business environment, this evolution from basic bookkeeping to integrated financial intelligence isn’t just an advantage—it’s an essential foundation for long-term success.